Ynab Classic Desktop

Ynab Icons - Download Free Ynab icons @ IconArchive. Search more than 600,000 icons for Web & Desktop here. Toolkit for YNAB is a general purpose extension that adds features to YNAB and makes it more flexible. Have it your way! There are many different features available once installing the Toolkit for YNAB. Jan 05, 2016 The YNAB implementation is unique in the finance management software market but it's based on a simple model called 'envelope budgeting.' YNAB preaches 'give every dollar a job' and the desktop app does a good job encouraging proper budgeting. I've discussed this at length on Nerds on Draft episode 19. At some point in 2017, the iOS YNAB Classic app stopped syncing properly. This was particularly frustrating because I liked being able to look up our budget on the go. This almost made me consider upgrading to the YNAB online subscription, but I ended up just deleting the app and only using the desktop version on my MacBook.

Check out these free budget spreadsheets and start telling your money where it should go!

Are you spreadsheet illiterate? Or worse….are you a spreadsheet fanatic? Do you pray at the altar of your budget or are you the type that can’t-keep-a-budget-to-save-your-life? Whichever way you rock it, you’ll find a budget spreadsheet (template) that works for you in the list below!

I fall into the category of “spreadsheet fanatic.” I loveeee me some spreadsheets (can you blame?…I’m an engineer!). If I’m in a situation that can be solved by creating a spreadsheet, my happiness level instantly doubles, probably triples if I’m telling the truth. I’ll find any excuse to create a spreadsheet.

This list below starts with the simplest, easiest spreadsheet that anybody can use. As the list goes on, the spreadsheets get more detailed, complicated, and are able to do more things.

1. Simple Budget (from Microsoft Corporation)

If you want to set the simplest budget possible (input income and set a value for spending for each budget category), then this your spreadsheet. All it does is add up all your income, add up your projected spending in each category, and calculate the difference of the two (which will tell you if you are making more than you spend, or vice-versa). This spreadsheet does not allow you to put in your expenses, so you can’t evaluate if you’ve stayed within your budget at the end of the month.

2. Personal Monthly Budget (from Microsoft Corporation)

Ugh, SSOOOOOO simple. And it prints on one page. Yes and yes. This spreadsheet is SOOOOO simple. It breaks your budget into several obvious categories (housing, transportation, loans, etc). At the beginning of the month you can enter the amount you project to spend. At the end of the month you can enter how much you actually spent. The spreadsheet will calculate the difference and also summarizes all the categories at the top and bottom. Best part, each monthly budget fits nicely onto ONE page, so it’s a clean and easily printable document. I love this. It does everythign you need. Perfect if you are just starting out. Perfect if you are looking for a printable document to put in your budget binder.

3. Budget Slasher (from Girls Just Wanna Have Funds)

Ynab Classic Download

This spreadsheet is set up just like a budget, but aims to help you slash your budget. It calculates how much your monthly savings will be if you follow your new, slashed budget. To get this spreadsheet, you have to go to the Girls Just Wanna Have Funds website, scroll down a little, click “Download Now” when you see the Budget Slasher spreadsheet, put in your name and email, and it’ll download the spreadsheet on your computer and open in Google Documents so you can download on your computer.

4. Monthly Budget Spreadsheet (from Money Under 30)

This first tab of the spreadsheet is your run-of-the-mill budget. It breaks your budget into categories, and you can input your budget for each category. But the part I really like about htis spreadsheet is that there are an additional 12 tabs, one for each month of the year. In each monthly tab, you can enter how much you spent in a budget category on a specific day….and then the spreadsheet will calculate how much of your variable expense budget you have left. The only thing that would make this better is if it told you how much money you have left in each category.

5. Simple Monthly Budget (from Zero Based Budget HQ)

This is super simple. It’s different from the other spreadsheets because you can input the percentage of your income you want to allocate for each category instead of inputting the exact amount you want to allocate. For instance, if you want to give 10% of your income to charity, you just write 10%, instead of having to calculate the amount like $230.

Ynab Classic Desktop Wallpaper

6. The Super Easy Budget Form (from Trees Full of Money)

This budget spreadsheet exploded on Pinterest….and for good reason. This spreadsheet is helpful if you have debt because it tells you the “extra money” you have (the money you haven’t budgeted) that could go towards paying off debt.

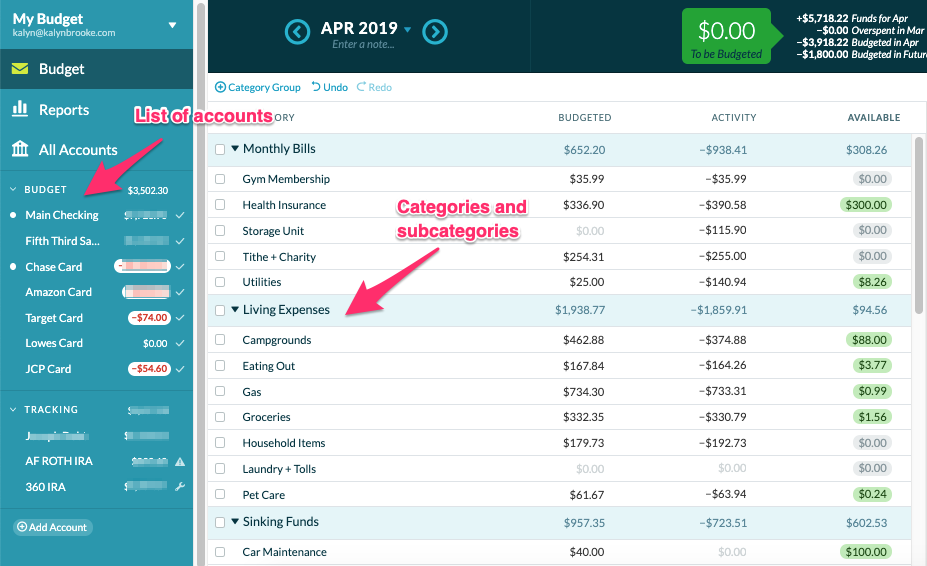

7. YNAB Style Spreadsheet (from a Redditor on Reddit.com)

As the name suggests, this spreadsheet’s layout and function is very similar to the paid budget software called YNAB (You Need a Budget). It’s perfect if you want to create a zero-based budget. The spreadsheet requires you to put in all of your transactions and categorize them. It’s a very visually appealing spreadsheet and it nicely summarizes each months’ available budget, income, and expenditures.

8. Updated Personal Finance Tracker (from a Redditor on Reddit.com)

This spreadsheet has the basics – a monthly budget (I like this because it has all 12 months in one tab, and it allows your budget to change from month to month) and a transactions log to record all your spending. But it also includes some extras – a savings balance sheet and a net worth tracker (and associated charts). This spreadsheet is great if you have some experience with excel, if your budget changes from month to month, and if you want a spreadsheet that has more than just a budgeting capability.

How do you keep track of your budget? Is it from a spreadsheet template like the ones above, using a digital program, or good old fashioned pen and paper?

If you're looking for an alternative to You Need a Budget (YNAB), you're in the right place. I’ve been closely following YNAB as it’s evolved over the last few years. I remember YNAB4 when it was a software application you purchased. I remember when it transitions to a monthly service. I remember how upset people were but I felt from a business perspective, it made them better suited to invest in the business to make it even better.

There are several reasons why you might be looking to replace YNAB. The best alternative for you will depend on why you're replacing it. Whether it was the recent price increase, outgrew the product, or you feel like you could do it on your own?

With plenty of options we breakdown the top 5 YNAB alternatives below.

Why Do You Want to Switch?

The YNAB Price Increase – YNAB used to be $50 a year, billed annually. It will now be $6.99 a month, still billed annually so $83.88. It's a sizable percentage increase but not a significant dollar increase, just under $3 a month.

I think it's worth $3 a month for YNAB but long-time users have had to navigate two pricing changes the last few years – first, when the software went from a flat fee to a monthly fee; now, to a slightly higher monthly fee.

To put it into perspective, EveryDollar is a budgeting app that has a free component but costs $129.99 a year for their Ramsey Plus (they rebranded it and added features to what was previously EveryDollar Plus).

It follows Dave Ramsey's Total Money Makeover approach, has a similar “give every dollar a name” philosophy, and is on a freemium model. That means the app is free but if you want to connect financial accounts, download data automatically, that'll run you $129 a year. It's still cheaper than one of their most similar alternatives (which we don't list below because it's more expensive).

You've Graduated – Congratulations! YNAB has put many people on the path to sound budgeting with its “Every Dollar Needs a Job” mentality. If you're ready to graduate to a free tool without as much guidance, then there are several options below.

If you need less guidance and you want more support in the area of investing and retirement planning, my best recommendation is Personal Capital. It offers a personal finance dashboard that lets you plan for your investments and retirement better than any of the alternatives.

If you need less guidance and just want to track your budget, my best recommendation is Mint. Track your budget automatically, completely free, but you don't get the same philosophy and guidance as YNAB. We compare YNAB vs. Mint in a head to head comparison that you can use to decide if mint is the one for you.

What We Looked For

You chose You Need a Budget for a specific reason and it's not just to “track your budget.” There are a ton of budgeting apps out there and most of them are free.

You chose YNAB because of the philosophy and how the tools married with those philosophies. You wanted more than a simple tracker tool.

We also didn't include alternatives like EveryDollar (until the end) because they were more expensive. We recognize YNAB is pretty solid on features so you're probably looking for a cheaper replacement rather than a more expensive one. (if we're wrong, let us know!)

1. Tiller

What is Tiller?Tiller is an automation tool that integrates with Google Sheets so you can build your own budgeting spreadsheet while pulling in data automatically from your accounts.

Why is Tiller a good YNAB alternative? First and foremost, they have a way to import your YNAB budget into a Google Sheet. So if you wanted to make the transition, it's super easy.

Second, and this is more about spreadsheets than about Tiller specifically, but you get complete control and customization with Tiller powering your spreadsheet. You tailor the spreadsheet to exactly what you want and they pull in the data so you avoid the manual data entry. I use a spreadsheet for this very reason.

Ynab Download 4

Tiller is just $79/year after a 30 day trial, which makes it slightly cheaper than YNAB. If you start using it and are able to save more money in your budget, those savings could easily pay for Tiller. Read our Tiller review for a deep look at what makes this tool so great.

2. Personal Capital

What is Personal Capital? Personal Capital is a personal finance dashboard that will aggregate all of your accounts in one place. They have a premium financial advisory service as well as wealth management, but those are optional (I don't use them). There are also powerful planning tools, like planning future income in retirement based on your expenses, that really make it a 30,000 foot view other tools don't even try to do.

Why is it a good YNAB alternative? It's not a good budgeting tool replacement for YNAB but if you want to graduate from just budgeting to higher-level financial management, Personal Capital can be a helpful tool. I don't mean “higher level” as in “better” or “superior,” I mean 30,000-foot view vs. 10,000-foot view.

Budgeting is crucial but it has a short-term view. You may budget your paycheck, which may be weekly, bi-weekly, or monthly. You may budget annually too – but you won't be budgeting from now until your retirement. That's why a tool like Personal Capital can be valuable – giving you visibility on the long term view.

Personal Capital is free.

3. Mint

Ynab Desktop App

What is Mint? Mint is one of the oldest budget tracking packages out there and they are owned my Mint, who were the former owners of Quicken. Mint has everything you need in a budgeting app and is completely free. Many of the budgeting tools may sound familiar to YNAB but they will take getting used to it. You have bill pay functionality as well plus additional features like credit monitoring and some investing tracking (but no recommendations or advice).

Why is it a good YNAB alternative? If you need a budget but don't want to pay for You Need a Budget, this one gets you all the budgeting functionality at absolutely no cost.

Mint.com is free.

4. CountAbout

CountAbout was designed specifically to be an alternative to Quicken, which is one of the oldest and most popular budgeting packages out there. CountAbout was founded in 2012 and offers a very rich feature-set at a very modest price. It costs just $9.99 for the Basic and $39.99 for Premium (which includes automatic transaction download).

Here are some of the other key features, making it a solid budgeting tool without the monthly fee:

- Imports data from Quicken and Mint

- 12,500+ financial institutions

- Multi-factor login protection

- Android and iOS apps

- Category customization (add, delete, rename)

- Tags (add, delete, rename)

- Reporting for Account balances

- Reporting for Category activity

- Reporting for Tag activity

- Report exporting

- Individual Account QIF importing

- Budgeting

- Running register balances

- Account reconciliation

- Graphs for Income & Spending

- Recurring transactions

- Investment balances by Institution

- Memorized transactions

- Split transactions

- Description renaming

5. EveryDollar

EveryDollar is a very basic budgeting tool created by the team behind Dave Ramsey, using his principles for managing money. We reviewed EveryDollar and found that it's claim of being able to set up a budget in 10 minutes to be accurate – it's super simple, very easy to navigate, and follows the overall structure of Dave Ramsey's Baby Steps.

It is a freemium product with the free version letting you do everything the budgeting tool offers. There is an EveryDollar Plus (now part of Ramsey Plus) that's $129.99 per year which adds in automatic transaction downloads and a few other features. With the Free version, you have to manually enter all of your transactions.

Conclusion

If You Need a Budget has served you well, my recommendation is to find a few bucks each month to continue paying for it. No tool offers what it does at a cheaper price and there's a reason why it's one of the most popular personal finance tools out there – it works.

One of the nice things about many of the recommendations on this list is that they have trials or are completely free. Keep with YNAB, try one of the alternatives we listed, and if it wins – switch. If it doesn't, you won't have lost a step with your existing budget.

Other Posts You May Enjoy